In recent days, criminals have been calling customers impersonating bank employees - the call is displayed as the real Alior Bank helpline number (e.g. +48 123707000, but criminals can set any). During the conversation, they most often refer to security reasons, such as account hacking and encourage you to quickly provide your data or install software that is actually used to steal funds from the account.

We are reminding:

More information about the return password can be found here (PL). If you have any doubts about the conversation you had with a person claiming to be a bank employee, call the hotline at +48 12 370 70 00.

We are reminding:

- Alior Bank employees never order any additional software to be installed on computers or telephones;

- Alior Bank employees never ask for a password to a bank account;

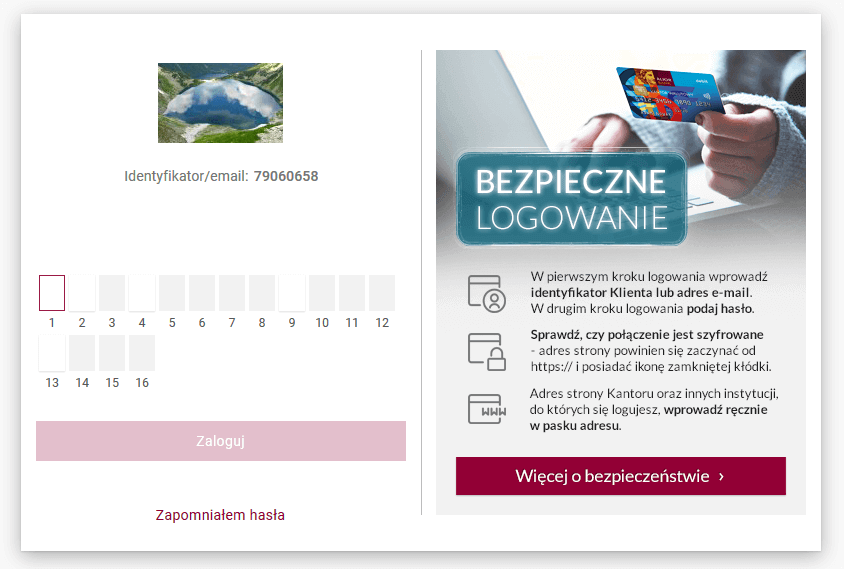

- if you have a return password set, ask the caller who claims to be an Alior Bank employee for it each time (never give it to anyone) - if he does not know it, end the conversation and inform the bank about this event;

- if you do not have a return password, set it - to do this, call the hotline and ask for a password invented by you, which a bank employee will have to provide you every time you call and ask for it;

- if the content of the conversation seems suspicious and unusual to you, and the caller requires you to take action quickly (e.g. providing your data, installing software, providing BLIK codes or one-time codes), hang up and call the bank's hotline to confirm the truth of such a conversation ;

More information about the return password can be found here (PL). If you have any doubts about the conversation you had with a person claiming to be a bank employee, call the hotline at +48 12 370 70 00.